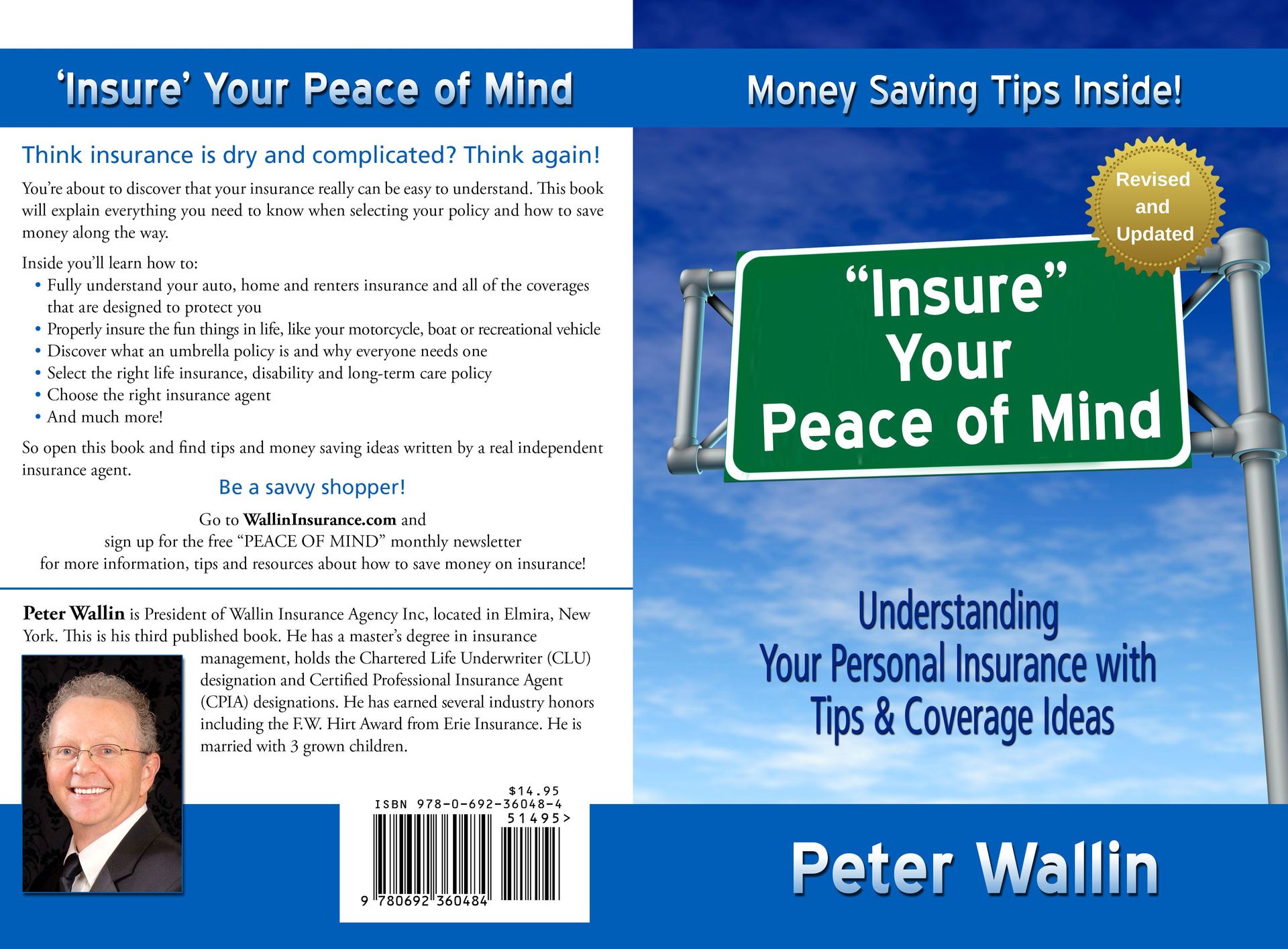

Book "Insure Your Peace of Mind"

Revised and Updated 2019

It was time for an update. I wrote this book in 2016 to share with my insurance clients. I distributed over 5000 copies and got rave reviews. The idea was simple: Educate them!

In early 2019, just a few short years later, I felt the need to create an updated edition. So much has changed that I wanted to discuss:

- Cyber crime is a real issue! It's not going away.

- Identity theft continues to be a growing concern.

- The flood insurance industry has changed and now there are private insurance companies offering coverage.

- New enhancements on home insurance to help with water backups in basements as well as utility line service coverage for broken or damaged underground pipes.

- How to properly put a value on property.

- Statistics on insurance claims.

- New information on Life and Disability Insurance.

- Why Dave Ramsey endorses Independent Insurance Agents

- you own a home or rent an apartment

- you own cool toys like a motorcycle, boat, or recreational vehicle

- you have children or are looking to start a family

- you haven't reviewed your existing policy in 3 or more years

- you had an unpleasant experience in the past like an unfair claim

settlement or poor customer service

- you are looking to better understand your coverages

- you are looking to save money - you are looking to truly find peace of mind

Not only is life complicated, but so is insurance. It is chock-full of rules, unfamiliar terms and acronyms that can really frustrate people.

I keep this book simple! I deliver easy-to-understand explanations of all the things you need to know about personal insurance. Whether you’re a newly licensed young driver, a married couple buying a home, or a retired couple looking to protect their assets, this book will help.

I've been in this business since 1987. More than half my life. Probably longer than some of you have been alive. I must be honest with you: times are more complicated today than ever. Here's why:

There are more lawsuits. You see that attorneys advertise more than anyone else. (Just watch one episode of Judge Judy and notice the commercials). Accident victims are drawn to the possibility of a large insurance payout.

Driving distractions. Texting while driving, XM Radio and Pandora in our cars can take eyes off the road. Add increased deer population (there are fewer hunters today than in years past) and never-ending road constructions to all of the obstacles we must be aware of.

Natural disasters are on the rise. Turn on the National news. It seems there are more floods, hurricanes and ice storms than ever before. In fact, according to the Federal Emergency Management Agency (FEMA) there have been an average of 108 natural disasters declared in the last 5 years (2013-2018), whereas 20 years ago the average was 51 per year (1989-1994). I never heard of “Polar Vortex” until just a few years ago. But it’s real, and so are broken pipes in homes because of freezing.

House fires. I’ve personally seen more scary house fires than I care to admit. And honestly, most of them are caused by human error. Cigarettes, space heaters, leaving a stove burner lit, and overwhelming electrical sockets beyond their capacity.

Cyber liability and identity theft are the fastest growing crimes in our world today. These concerns didn't exist 10 years ago. Now there are scams happening with stolen credit card details, retail stores computers being hacked and customer data taken, not to mention the passwords and personal information on our online banking. These issues are real! I see them every day.

Why have I written this book? Back when I was a teenager and I got my first car my dad said “Congratulations! Now go see Mr. Migliore, our insurance agent. He will explain to you what type of auto insurance you need and what it will cost you.” From that point on I had my own insurance even though I didn’t understand it very well. In today’s world, more often or not, I see many parents handling the insurance for their kids. I really don’t think these young drivers understand coverages and costs. Then, as they enter their 20’s and even their 30’s and buy their own car, home, motorcycle, etc., they really don’t have a clue This book is set forth in an easy-to-digest manner. Sort of a "Welcome to Insurance 101" guide intended to give you peace of mind. By fully understanding all the different types of insurance you will be able to construct your own insurance plan that provides solid coverage and a reasonable price.

The pages that follow were not written by some corporation or professor of finance looking to show their textbook knowledge of legal terms. Instead, it is written by me, an independent insurance agent. I own my own business and I see clients just like you every day. I am on the scene of a house fire, a major flood disaster, I speak to people who have just suffered a car accident and I attend funerals for those whom I have provided a life insurance policy. I am a real insurance agent. I have written this book using my personal experience to help my clients better understand the features and benefits of their policies. I want them (and now you) to be aware of the variety of options available and to help make proper decisions about overall financial protection. I have studied this industry for over 3 decades. I have a master’s degree in insurance management and have several letters after my name on my business card. More importantly, what I have learned the most is that this is a people business. People helping people in time of need. Bad things (house fires, car accidents, lawsuits) happen to good people. My job is to provide insurance knowledge to you so you can be sure to buy the right policy - and from the right person.

Money Saving Ideas Each chapter in this book will include a few tips for you to control the price you pay for coverage.

Proper Coverage Recommendations Yes, saving money and keeping your total insurance costs reasonable is important. However, I will go on record by suggesting levels of coverage for you to consider. While each person has a different situation, it is important to not get caught uninsured or underinsured. I will offer my hard-earned advice on what you should really consider for your own insurance plan.

True Stories I will share true stories of claims cases and situations where insurance was proper or improper. They are real stories that I have personally seen myself. These examples will offer critical advice to you as you further evaluate your own situation and make proper decisions.

My main objective for writing this book is to give you the best insurance knowledge so you can make an educated purchase now and in the future. I ask you to read and review the chapters in this book often and then share your increased knowledge with your family and friends.

Here’s to “insuring” that you will truly discover the peace of mind you covet! For a FREE COPY of my book, send me an email: Peter@WallinInsurance.com or call my Elmira, NY office at 607-734-8799.