Pedestrian Accidents on the Rise

SUV's have become the reason for increased concerns

Since 2009 accidents involving pedestrian fatalities have risen by 81 percent in the United States. This is an alarming fact as presented by the Insurance Institute for Highway Safety. I have to wonder why this trend has occurred and what we can do about it.

As an insurance agent in Elmira, New York, I have seen my share of single-car accidents where a walking pedestrian or bicyclist is injured. In one case, a client of mine was involved in an accident where he struck a man riding a scooter. Apparently the driver claimed she did not see the scooter as he rode right into her vehicle. The man on the scooter was killed.

I have talked to drivers of cars I insure who claim the person was crossing the street and walked directly into them as they approached an intersection. I also remember a situation where my client was driving at dusk when a person walked across the street and was struck and killed. It was later determined that the pedestrian was drunk, whereas the driver of the vehicle was not.

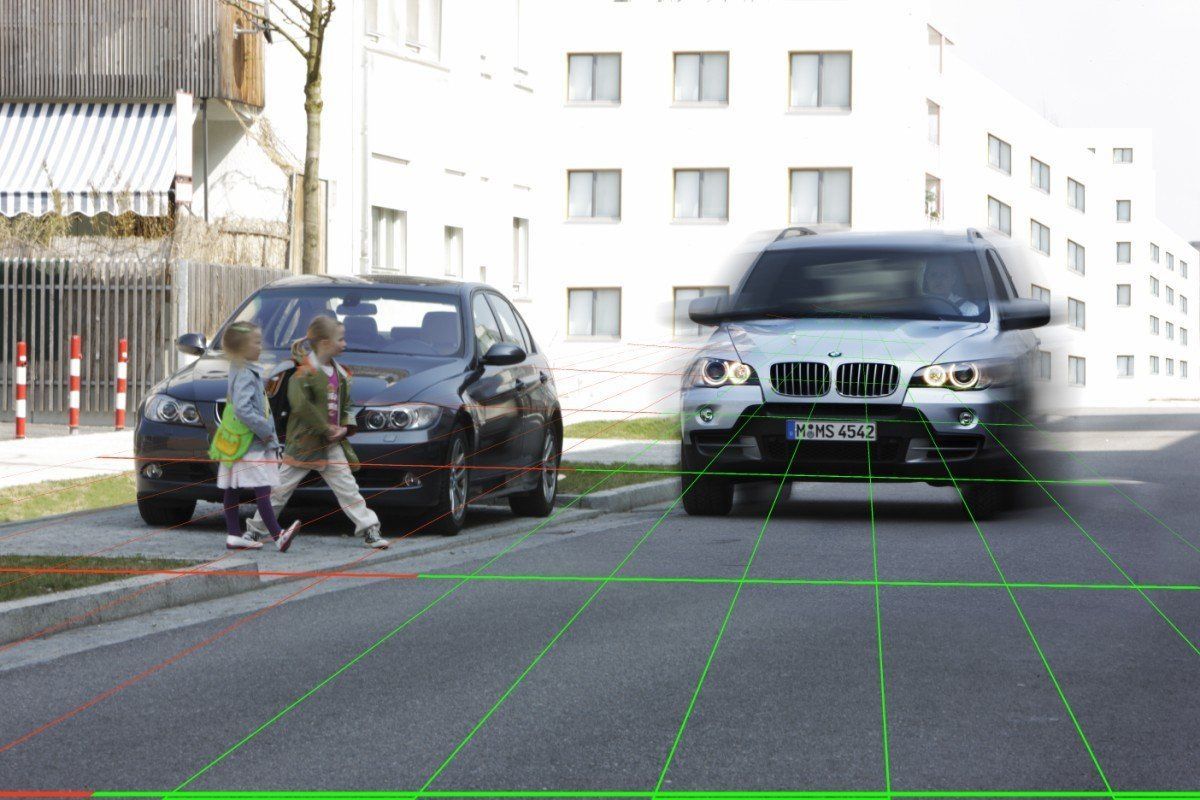

While these situations are very unfortunate there is a growing trend that there has been an increasing number of fatal accidents involving pedestrians where a certain vehicle type is involved. A Sport Utility Vehicle (SUV).

A recent article from the USA Today made front page news as it confirmed the number of pedestrian accidents have increased at an alarming rate. Almost 6000 people were killed in 2016 alone and the majority of them occurred with an SUV. The reasons sited is the increase in the number of SUV's that are now on the road. SUV's are a constant factor in the increase and account for a steadily growing proportion of deaths.

Facts about SUV's

- They now make up 60% of all new vehicle sales in the United States. There are more SUV's on the road now than ever before. Ford Motor Company recently announced it will stop making sedan vehicles as they see the this trend continuing in years ahead.

- SUV's have higher front-end builds compared to a regular sedan. When a pedestrian is struck by an SUV the impact on a human body is much more serious (hit in midsection) and would likely kill a person whereas a sedan more likely will strike a person's leg.

- Federal proposals to factor pedestrian into vehicle safety records have stalled in recent years (According to USA Today).

- A rising tide of fatalities have occurred in urban areas that kills minorities as a disproportionate rate.

And then there's speeding

For vehicles that travel less than 20 mph there's only a 5% chance of a pedestrian fatality. At 30 mph the percentage increases to 45%. At 40 mph the percent goes to 85%.So, the faster one drives, particularly in urban neighborhoods, so more likely a serious accident can occur.

What's up with Pedestrians?

- Distractions - they may be texting while walking, or using earplugs and cannot hear oncoming traffic.

- They may not be obeying traffic signals and crosswalks properly. There's still plenty of jaywalking occurring today.

- Even if they don't die, there may be serious injuries. Attorney's pounce on opportunities and start lawsuits that take years to settle.

The bottom line is that SUV's can be dangerous. As a driver I suggest you take it slow in urban areas and pay close attention to intersections and crosswalks. As a pedestrians we all have to deal with numerous distractions, road conditions and confusing cross walks. Be careful and drive safely. And as an insurance agent I'd hate to see you be involved in a terrible ordeal that can change your entire life.

For more information about how accidents involving fatalities can affect your insurance rate, please contact me at Peter@WallinInsurance.com.

To get a quote for insurance, complete our online form: https://www.wallininsurance.com/request-an-auto-quote.